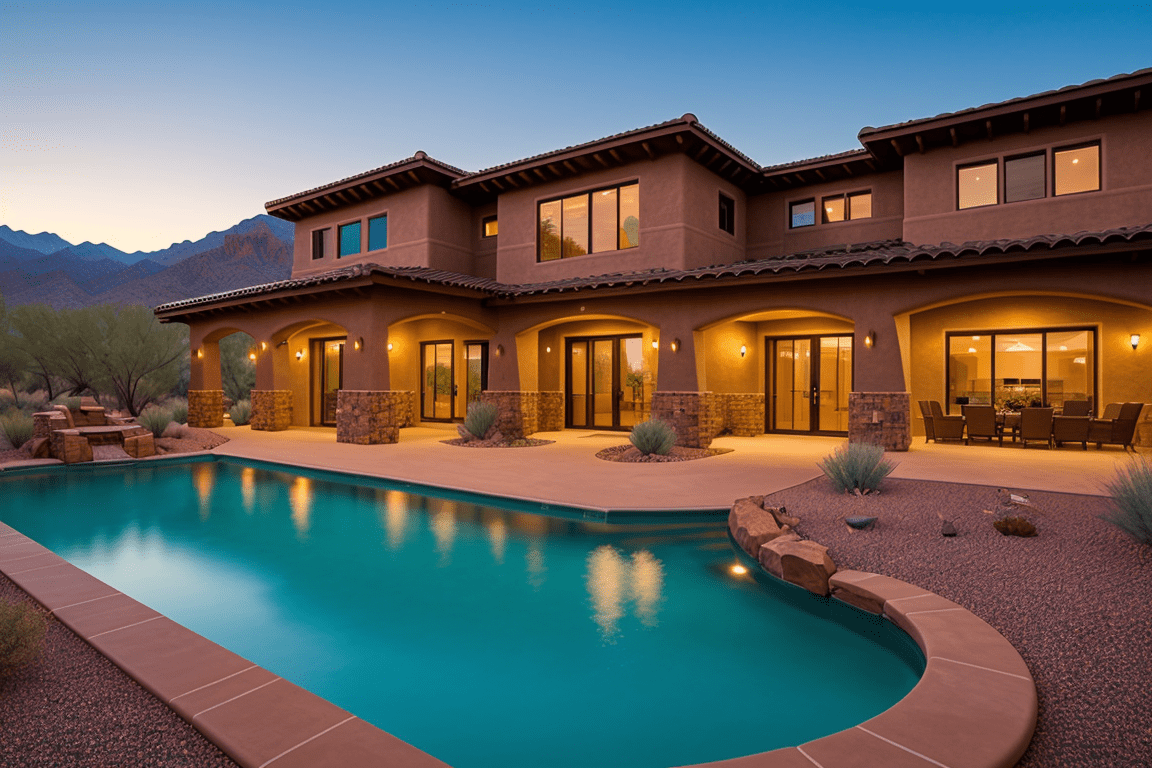

Phoenix, AZ has rapidly become a hotspot for real estate investors, particularly for those focused on single-family rental properties. With its burgeoning tech industry, excellent schools, and diverse community, it’s no wonder that Phoenix is drawing attention. If you’re considering underwriting a single-family rental property in this dynamic city, here’s a guide to help you navigate the process.

Understanding Underwriting

Underwriting in real estate is essentially the process of evaluating the risk of lending money or investing in a property. It involves a thorough analysis of various factors to determine whether the investment is sound and likely to yield the expected returns. In the context of single-family rental properties, this means assessing the property’s potential to generate rental income, its appreciation prospects, and the associated risks.

1. Market Analysis

Before diving into the specifics of a property, it’s crucial to understand the local market dynamics in Phoenix. Here are some key points to consider:

- Economic Growth: Phoenix boasts a diverse economy with major employers in tech, healthcare, and finance. Companies like Honeywell, Intel, and American Express contribute to economic stability, attracting a steady influx of residents and boosting demand for rental properties.

- Population Trends: Phoenix is one of the fastest-growing cities in the U.S., presenting a growing pool of potential renters.

- Rental Market: Research current rental rates, vacancy rates, and trends in rental demand. Phoenix’s rental market is competitive, with rising rental prices and low vacancy rates indicating high demand.

2. Property Evaluation

Once you have a grasp on the market, the next step is evaluating the specific property you’re interested in. Here’s what to focus on:

- Location: Proximity to schools, parks, shopping centers, and employment hubs can significantly impact a property’s rental appeal and value.

- Condition: Conduct a thorough inspection to assess the property’s condition. Look for any potential repairs or renovations that could be needed, as these will impact your initial investment and ongoing maintenance costs.

- Comparative Market Analysis (CMA): Compare the property with similar rental properties in the area. This will help you gauge the rental income you can realistically expect and ensure you’re not overpaying.

3. Financial Analysis

Financial analysis is essential for underwriting a property. Here’s a step-by-step approach:

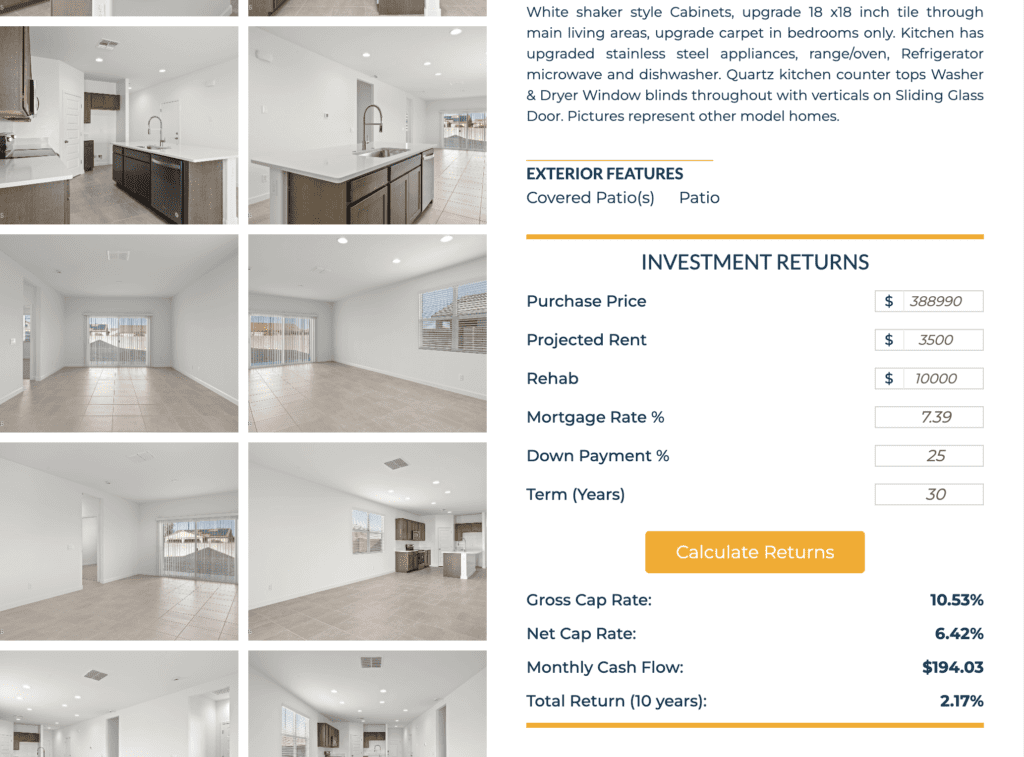

- Rental Income: Calculate the potential rental income based on current market rates and the property’s features. Be conservative in your estimates to account for potential vacancies.

- Operating Expenses: Identify all operating expenses, including property management fees, maintenance, insurance, property taxes, and utilities. Having a detailed budget will help you understand the property’s cash flow.

- Net Operating Income (NOI): Subtract operating expenses from rental income to determine the property’s NOI. This figure is crucial in assessing the property’s profitability.

- Capitalization Rate (Cap Rate): Divide the NOI by the property’s purchase price to determine the cap rate. This metric helps you compare the profitability of different investment properties.

- Cash Flow: Calculate the property’s cash flow by subtracting debt service (mortgage payments) from the NOI. Positive cash flow indicates the property can generate income after covering all expenses.

- Underwriting Widget: Reduce manual work and use the Investment Returns widget on https://www.lafisherinvestments.com/ to calculate the underwriting for a property.

4. Risk Assessment

Every investment carries risk, and underwriting a single-family rental property is no exception. Consider the following:

- Market Risk: Changes in the local economy or housing market can impact rental demand and property values.

- Tenant Risk: The risk of tenant turnover, vacancies, or non-payment. Mitigate this by conducting thorough tenant screening and maintaining a good relationship with tenants.

- Maintenance Risk: Unexpected repairs or maintenance issues can arise. Setting aside a reserve fund for such expenses is a prudent strategy.

- Financing Risk: Interest rate fluctuations can affect your mortgage payments and overall return on investment.

5. Financing Options

Explore various financing options to determine the best fit for your investment strategy:

- Conventional Loans: Typically offer lower interest rates but may require a higher down payment.

- FHA Loans: Ideal for first-time investors, with lower down payment requirements but stricter property condition guidelines.

- Private Lenders: Can provide more flexible terms but often come with higher interest rates.

- Cash: Allows for quick closings and no interest payments, but requires significant liquid funds.

- Creative Financing: Includes non-traditional methods such as assumable mortgages (taking over the seller’s loan), subject to financing (acquiring property with the existing mortgage), seller financing (seller provides the loan), lease options (renting with an option to buy), wraparound mortgages (new loan wraps around existing loan), and partnerships or joint ventures (sharing capital and risk).

Underwriting a Single-Family Rental Property

Underwriting a single-family rental property in Phoenix, AZ is a process that requires careful consideration of market conditions, property specifics, financial metrics, and potential risks. By conducting a thorough analysis and leveraging local insights, you can make an informed investment decision that aligns with your financial goals.

Whether you’re a seasoned investor or a newcomer to the real estate market, Phoenix offers a promising landscape for single-family rental properties. With its strong economic foundation and growing population, the city provides fertile ground for rental income and property appreciation.